- Ontime payroll client portal how to#

- Ontime payroll client portal software#

- Ontime payroll client portal plus#

Ontime payroll client portal software#

For online tax deposits made via the Electronic Federal Tax Payment System (EFTPS) or various state websites, the user names and passwords for the client should also be kept secure, and this also applies to the passwords for software used to process the payroll and for direct deposit of paychecks. If the CPA is printing payroll checks, the checks should be kept in a locked, secure cabinet, and only personnel who process payroll should have access to them. Procedures for CPAs That Process Clients' Payroll Checks and Make Tax DepositsĬPAs processing payroll checks and making tax deposits online should consider access and security issues and be careful if they have access to a financially troubled client's bank account. In Erwin, if the accountants had promptly resigned in writing, they may have avoided such hard scrutiny. Two- party, signed engagement letters can minimize confusion and clarify responsibilities between the client and the CPA, outline fee and payment terms, and emphasize the importance of filing deadlines, logistics, and other key aspects of the client arrangement, such as how the CPA can resign from the engagement. Follow an Engagement LetterĬPAs who perform payroll and sales tax return preparation-which might not be within the purview of the Statements on Standards for Accounting and Review Services (SSARS)-should use engagement letters for those services. This item reviews the relevant requirements, procedures, or other issues for CPAs who offer payroll services. That is a time- consuming and expensive lesson.

Ontime payroll client portal plus#

Nevertheless, the two accountants were each found jointly and severally liable for $325,000 plus penalties and interest. Of course, the owner of the business was held to be a responsible person as well. In it, the court concluded that accountants had significant authority over the finances of the client, so they were "responsible persons" under Sec. The Erwin case is an important reminder that an accountant can be held liable for a client's unpaid employment taxes. They are even scarier if they are assessed against a CPA who provides payroll services to the client. You can request a call back to get personalized quotes.Payroll tax penalties are scary when they are assessed against a client. Pricing of Ontime Employee Manager software depends upon the extent of usage and requirements of the user. Plus, HR teams can monitor the attendance for payroll and other functions.

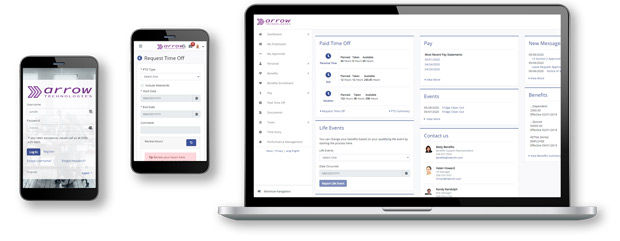

For managers, they can supervise and schedule the work to the employees from the office. For employees, they can receive their daily tasks through the application and send report from the mobile application. Ontime Employee Manager automates various tasks for different individuals to streamline and speed up the workflow considerably. How does Ontime Employee Manager help run a business efficiently? What features does Ontime Employee Manager offer? Reports of the meeting also get updated within a short duration. Furthermore, this time tracking software enables users to put their remarks of the meeting right after it ends. Plus, they can share the scheduled daily work with the workforce with a single click.Īlso, employers can directly share the daily work schedule with their workforce. The mobile application allows managers to track the location of employees in real-time. It provides flexibility to the employees and managers. Plus, they can report their location, which can be approved automatically through the system.

Ontime payroll client portal how to#

How to manage the workforce with Ontime Employee Manager?Įmployees can clock their attendance from appointed location through mobile application provided by Ontime Employee Manager. Ontime Employee Manager focuses on complete automation of workflow supervision and reporting. It enables employees to report from a landline telephone as well. Ontime Employee Manager authorizes managers to check their employee’s work in real-time and receive minute reports. Ontime employee management system helps in improvement of communication systems and keeps track of employee attendance, while boosting the staff accountability. It eliminates tedious scheduling processes, thus saving time. The solution enables users to supervise their employees from a remote geographical location and monitor their daily workflow.

Ontime Employee Manager assists HR teams in managing the workforce and the setup of office work hours for the employees efficiently. Ontime Employee Manager Software Overview What is Ontime Employee Manager?

0 kommentar(er)

0 kommentar(er)